Having worked with many early stage businesses and start-ups over the last decade, I have become very well versed in working with entrepreneurs and trailblazers. I am passionate about empowering Australians with the tools to grow successful businesses and below I have given an insight into my top 10 tips on getting your business from a start up to started-up.

Author Michael Kerwin

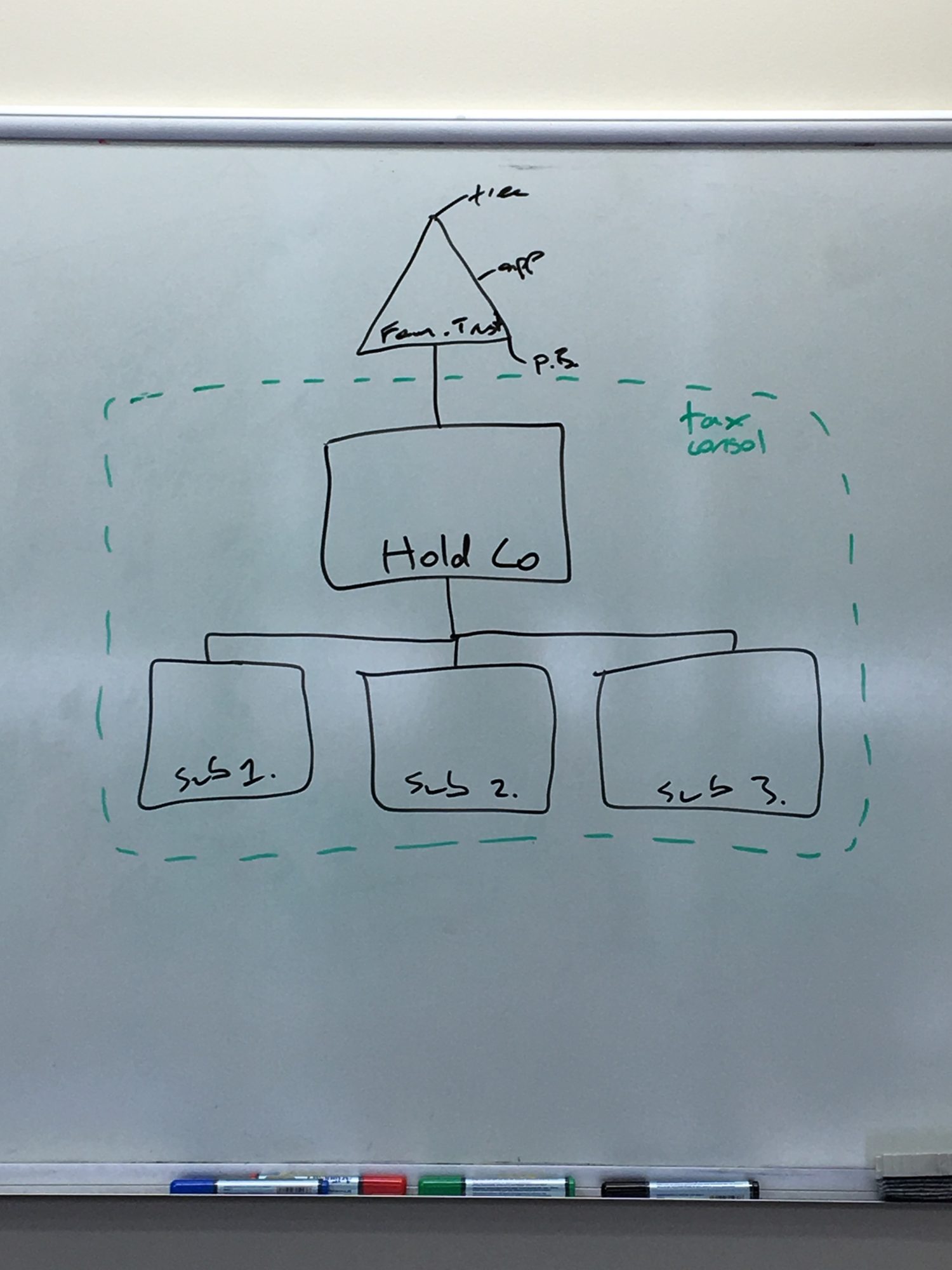

1) Business structure

Having a business structure (and the correct one) from the outset is critical to the success of any new venture. There is not a one size fits all approach to this, businesses come in all shapes and sizes so a cookie cutter approach will not do. You need to speak with someone who is a recognised specialist in this field to get this right from the outset as the consequences of getting it wrong can be dire.

2) Limited liability protection

Things can go wrong, and although I think the number is a little skewed and misrepresentative of what I see, the failure rate of start-ups in Australia is quite high (the number seems to vary depending on the source, but most report the vast majority of start-ups fail within the first 2-3 years). Being as prepared as possible we hope not to be one of those statistics, but if something does go wrong we want to ensure we are trading in a structure that protects us as best as possible, ultimately separating assets from liabilities and minimising the fallout should that worst-case scenario occur. This is even more applicable if you are an entrepreneur with a number of business interests in ensuring the quarantining of risks between the various business activities.

3) Tax flexibility

Trusts (discretionary/family) still are king (at least for now). While the Labor Party’s recent proposals have cast a light on deemed inappropriate use of trusts, it does also shed a light on just how powerful legitimate and appropriate use of trusts can be for small business owners through to high net worth individuals. Like all great things in life, simply having one is not the golden ticket, but a trust used correctly can be a very powerful tool for a variety of reasons including effective taxation planning, succession/estate planning, and as an added layer of asset protection.

4) Network = Net Worth

Surround yourself with professionals from different industries for differing perspectives, but also people who have been there, done it, and are experienced in the many facets of small business and the challenges and rewards that come with starting your new venture. To borrow a quote from one of my amazing clients – “your network is your net worth”. Surround yourself with no one and your business journey will be a struggle. Surround yourself with a diverse range of experts and associates who add value to your business and the possibilities are endless.

5) Engage Professionals

Don’t try to be everything to everyone and wear all the hats. Sometimes this is forced upon start-ups when funds are tight and budgets don’t permit, but it is critical experts are engaged to guide you through, accounting, regulatory and legal minefields that exist to ensure you are on the right track for success.

6) Protect your assets

Whether your assets are tangible or intangible they need protecting. Ensure you have the appropriate insurances in place for all business risks identified. Ensure you have appropriate protections in place for your intellectual property and ensure the valuable IP is not at risk from internal or external threats.

7) Shareholder Agreements

Get on the same page & prepare a (good) agreement with fellow business partners. Going in to business together is akin to a marriage. Much like a divorce, a business dispute or separation can quickly become very messy, so you must ensure that everyone knows what they’re getting in for, what the vision is and how we are going to get there, but also knowing how we will resolve issues should they arise. It is much easier to have these discussions in the early stages while everyone is in the “honeymoon phase”, than later on when all has gone pear-shaped. Disputes between business owners is one of the top 3 reasons for business failure in businesses with multiple founders/owners. The reason that these matters can’t be resolved is usually due to either no agreements or poorly drafted agreements being in place.

8) Know your numbers

While I’m not suggesting you ignore point 5, you do need to surround yourself with people who can assist in the monitoring and projecting of your finances and give you the skills to be able to know figures, especially the cashflows of the business. The cash is king mantra applies to businesses at just about every stage of the business life cycle, but is especially important in a start-up as you can very quickly find yourself running out of money before your venture has the chance to succeed if you do not know your numbers. It is also very difficult to make correct strategic business decisions if you do not have a grasp on your numbers.

9) Don’t forget the free money

Money doesn’t grow on trees, but we are seeing both state and federal governments provide more and more support for start-ups and entrepreneurs. Ensure you are reviewing all potential tax breaks, grants and concessions that may be available for your venture.

10) Know your end game

Never plough full speed into a new business without a clear focus on what you are trying to achieve, the problem you are solving and why you are doing this. But even more importantly know the end game and what your exit strategy is. Some clients I see wish to be the next globally dominant powerhouse, some wish to grow a business to a modest size to provide for themselves & their families, while some have no intention in being in the business forever and desire to position themselves for a sale from early on. There is no right path or answer, but knowing the end game can ensure that you, along with advisers can work on, grow, structure and position your business appropriately.

If you are embarking on a new venture, or wanting to grow your existing business you can’t afford to not have the experts in your corner. To grow your business venture, arrange a meeting with Michael Kerwin immediately. If you mention this article, your initial 1 hour consultation will be free of charge.