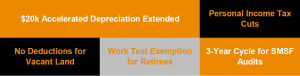

$20k Accelerated Depreciation Extended

The ability for small business entities to claim an immediate deduction for assets costing less than $20,000 has been extended until 30 June 2019.

From 1 July 2019, the immediate deduction threshold will reduce back to $1,000.

Personal Income Tax Cuts

From July 1 2018:

The 32.5% personal income tax bracket limit will increase from $87,000 to $90,000. This will save $135 of annual tax for people earning at least $90,000. The low income tax offset will also be increased, with those on incomes less than $48,000 to receive the major benefit.

No Deductions for Vacant Land

Deductions will be denied for expenses associated with holding vacant land. The Government is concerned that deductions are being improperly claimed for expenses, such as interest costs, related to holding vacant land. The detail has not been published and we wait to see how this will affect property developers.

3-Year Cycle for SMSF Audits

It was announced that SMSFs with a history of good record-keeping and compliance (three consecutive years of clear audit reports and annual returns lodged on time), will only be required to have their fund audited every three years. The announcement advises that the industry will be consulted on how to practically achieve the cut in red tape, which on first consideration seems very difficult.

Work Test Exemption for Retirees

A limited exemption to the work test will be introduced for people aged 65 to 74 with superannuation balances below $300,000, to allow people to make voluntary contributions to superannuation. Currently once you are over 65 this is only possible if you are ‘gainfully employed’ in the year. The proposal is to allow contributions in the year following the cessation of gainful employment as well.