With the commercial leasing market becoming increasingly competitive and supply often exceeding demand, it is becoming common place in many areas for landlords to offer incentives in order to secure tenants.

Various incentives are offered to help entice potential tenants, such as rent free or discounted periods, free fitouts or contributions, covering of relocation costs – just to name a few.

Author Lauren Kerwin

These are obviously very attractive when you are looking at signing a commercial lease, which is usually one of the larger overheads a business incurs. However, it is really important before signing off on a lease which may offer a shiny incentive to also be aware of how this translates for you from a tax perspective.

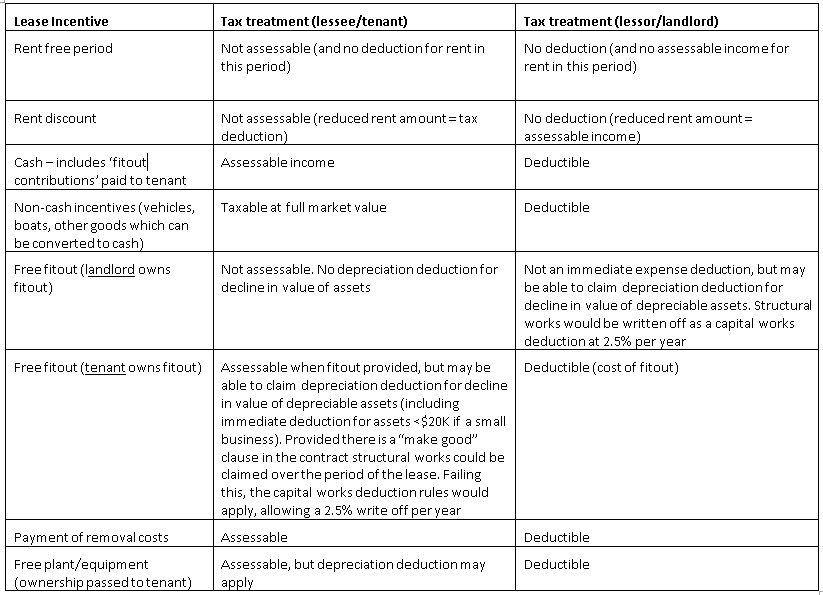

While there are many factors to consider and your particular circumstances should always be discussed with one of the experts in the Hoffman Kelly team, below is a brief summary of the tax ramifications of common incentives:

Commercial leases also have a number of other considerations for your business such as GST, taxation requirements and other financial rights and obligations, which have not been covered in this article, but should also be discussed with us and considered. In summary, lease incentives are being commonly offered by landlords and can alleviate the costs associated with leasing commercial premises as a tenant, or can be a great way to secure a tenant as a landlord. However, you should ensure you avoid any nasty unforeseen tax ‘surprises’, maximise the net after tax outcome of your lease position, and ensure that any incentives are clearly documented in your lease agreement. If you would like to discuss tax aspects of your current of proposed commercial lease positions (as a tenant or landlord), you should contact one of our experts at Hoffman Kelly.