The implications of COVID-19 for businesses are severe, far reaching and currently still ongoing. Many business owners have been forced into the unenviable position of deciding between staying open and potentially making a loss, or closing the doors and reducing turnover to nil, with knock-on effects such as losing staff or breaking leases.

How does a business decide whether it is better to keep going at a reduced turnover level, or cease trading temporarily?

One of the most important tools we have in our arsenal to help us decide the answer to this question is the calculation of the breakeven point. Simply put, the breakeven point is the turnover level at which a business makes no profit and no loss – it breaks even.

To calculate this we need to first split our expenses out into variable and fixed costs.

Variable costs are those expenses that change depending on the sales made – for example, a manufacturing business would consume raw materials in line with its sales – if sales increase, so does the consumption of materials. For a service business, the wages of the staff generating the income will be a variable cost – for example, a law firm will have lawyers’ wages as a variable cost.

Fixed costs are those expenses that do not vary in line with turnover – for example rent, licences and rates.

Once we have allocated our costs into variable or fixed, we need to determine how the variable costs move in relation to turnover. This is also known as our gross profit %. For example, a company that buys aluminium at $2 per kilo, manufactures 100 widgets with this kilo and sells them for $0.05 each will make $0.03 gross profit per widget on a cost per unit of $0.02. This $0.03 is 60% of the sale price of $0.05, so our gross profit % is 60%.

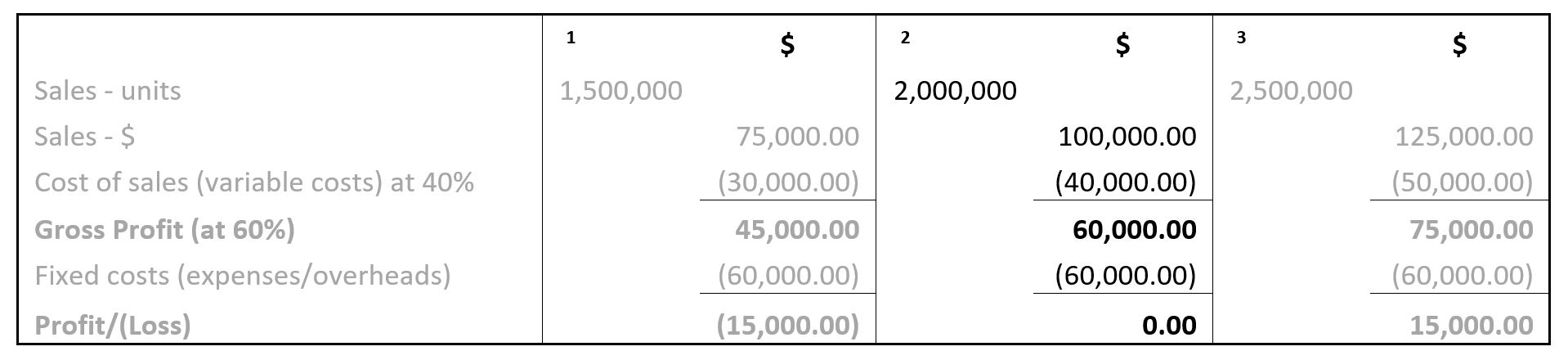

We then need to add up all of our fixed costs to obtain a total for the year. In the example above, let’s assume that the Widget Supply Company has total fixed costs (or overheads) of $60,000. Running the numbers on a gross profit % of 60%, it needs to sell 2,000,000 widgets to generate sufficient gross profit to cover its overheads, and the breakeven point in this situation is 2,000,000 units or $100,000:

As you can see, sales of 2,000,000 units2 will generate sufficient gross profit to cover the overheads exactly. Sales below this1 will result in the business making a loss, while sales over this3 will generate a profit (of $0.03 per unit).

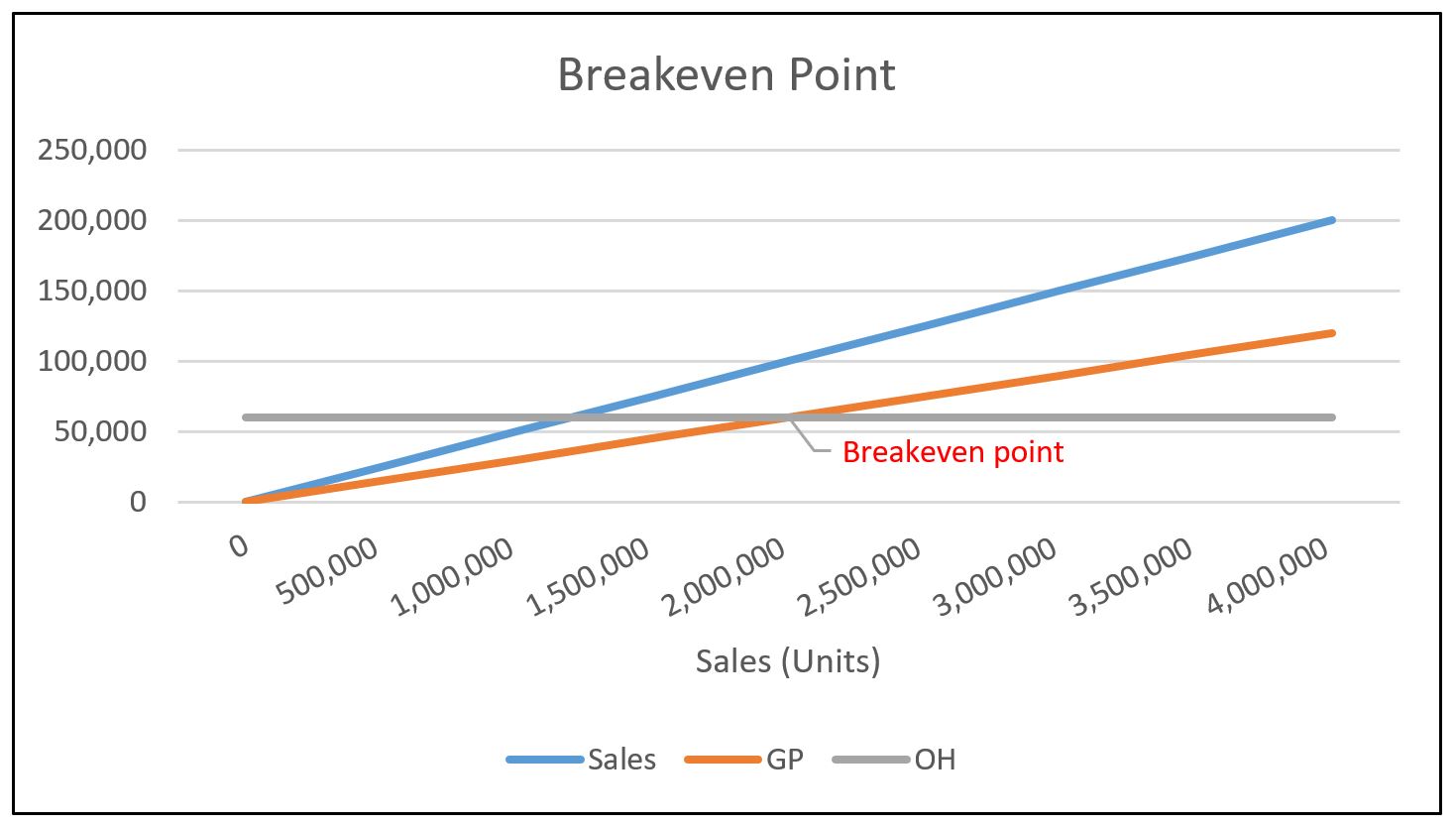

A visual representation of this would be:

The breakeven point is where the gross profit generated (GP, shown in red) crosses the overheads line (OH, shown in grey).

If you would like to calculate the breakeven point for your particular business, or discuss driving your business efficiency in more detail, please watch the videos on our website here and here, or give me a call to arrange a complimentary meeting.