Next steps to be taken if you believe you are an eligible employer:

- Contact your Hoffman Kelly advisor for full advice confirming your position and assistance with all required steps if you would like us to assist you with these claims.

- If you would prefer to undertake the enrolment/application process yourself, we suggest you follow the steps below.

- Please ensure you speak to your Hoffman Kelly advisor to ensure you have been advised appropriately on all eligibility requirements first

- Complete all ATO required forms to enrol from 20 April onwards, found here

- Ensure you have acceptances from employees

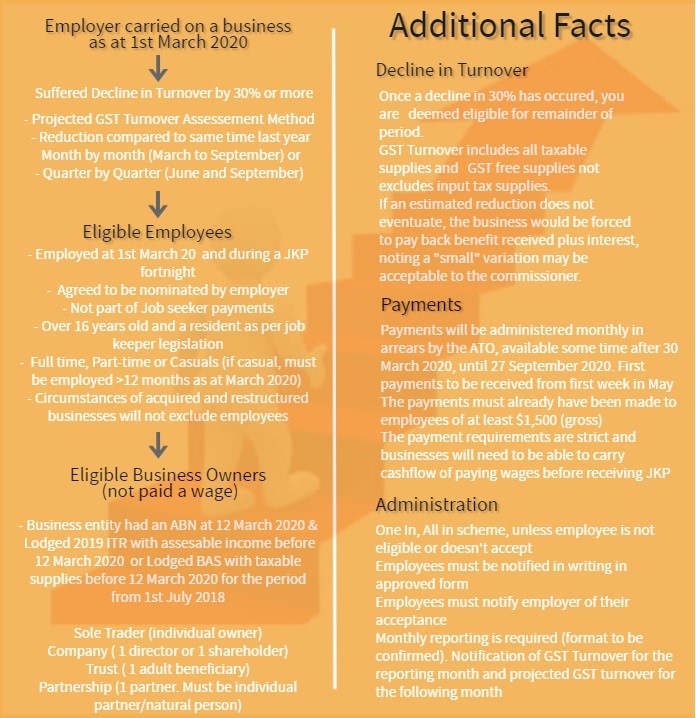

- Pay all eligible employees at least $1,500 gross per fortnight, including staff who were usually paid less and/or were stood down. Two fortnightly payments or one combined payment (i.e. $3,000 gross per employee) must be paid before end of April to receive full JKP)

Examples

Employee previously paid $1,000 per fortnight (incl super)

Employer pays existing wage of $1,000 (incl super) + additional $500 top up (no super)

Employer receives $1,500 per fortnight JKP

Employee previously paid $2,000 per fortnight (incl super)

Employer pays usual wage of $2,000

Employer receives $1,500 per fortnight JKP

Trust Structure SME

John is a plumber and is running his own business in a trust, while his wife, Anna, works in an administration role in the business. Neither are paid wages but instead, take distributions from the trust at the end of the year. The business satisfies all turnover requirements. The trust can only elect either John or Anna for JKP.

Company Structure SME

Karen and Anthony are running a successful office fit out business through a company. Karen and Anthony are both directors and taking director fees at the end of the year. The business satisfies all turnover requirements. The company can only elect either Karen or Anthony for JKP.